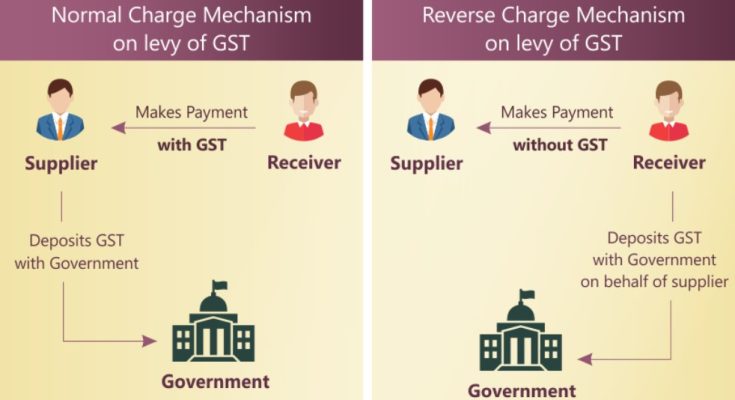

Reverse Charge (PDF about Reverse Charge) means the liability to pay tax is on the recipient of the supply of goods or services instead of the supplier of such goods or services.

Recipient of goods or services discharges GST under RCM as if he is the person liable for paying the tax on the supply procured by him. All provisions of the Act including the collection, recoveries, and penal provisions apply to the recipient and he is required to pay applicable tax i.e., CGST and SGST/ UTGST, or IGST depending on the location of the supplier and place of supply. The tax liability needs to be discharged under RCM at the applicable rate of tax.

Reverse charge applies only when there is a charge on supply. If supply is exempted, nil rated, or non-taxable, RCM does not apply in such a case. Recipient of goods or services discharges GST under RCM as if he is the person liable for paying the tax on the supply procured by him.

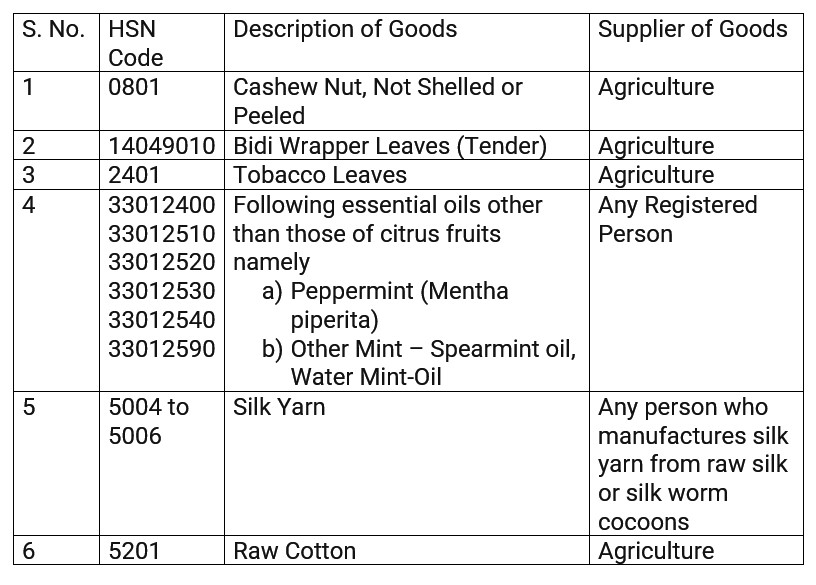

The government has introduced new list under the RCM vide Notification NO. 14/2022 Central Tax (Rate) Dated on 30TH December, 2022. The recipient who is registered under GST has to deposit the GST.

Do leave a comment if you have any queries.